May 17, 2024

Learn about life insurance, including its types, benefits, and how it works to provide financial security.

Feb 23, 2024

In difficult economic circumstances, individuals are often left scrambling for cash to fulfill the demands of their lifestyle and the day-to-day costs of living. You may indeed cash in your life insurance policy to get the money you need

Feb 05, 2024

Learn how Card Lock ensures secure transactions through its locking mechanism. Explore features and benefits from different providers in this straightforward guide.

Feb 03, 2024

Explore the differences between comprehensive and collision coverage to choose the best auto insurance for your needs and ensure vehicle protection.

Feb 02, 2024

A third party bank payment processor is an intermediary facilitating electronic transactions between buyers and sellers, ensuring secure and efficient financial transactions online.

Feb 02, 2024

Take control of your finances and reach your savings goals with the top 9 personal expense tracker apps in 2024. Stay organized, and track your spending. Lick to read more.

Feb 02, 2024

An Additional Insured Endorsement is a policy modification that extends coverage to parties beyond the named insured, protecting specified individuals or entities.

Feb 02, 2024

The supply production chain is the systematic coordination of processes, people, activities, information, and resources involved in the production and distribution of goods or services.

Feb 01, 2024

Charles Schwab vs Fidelity, both prominent financial service companies, compete by offering diverse investment options and low fees. Investors choose based on preferences.

Feb 01, 2024

eBay payments simplify payment processing for sellers. Simple financial tracking and improved security make it a complete online commerce solution. Click to read more.

Jan 30, 2024

Explore different business entity types, their characteristics, advantages, and disadvantages, and how to select the right structure for your business.

Jan 30, 2024

Want to use your Hertz Gold Plus Rewards? Read about elite level membership advantages and point redemption techniques.

Jan 30, 2024

Older people's expertise is valuable in labor shortages. Click here to read how their expertise, flexibility, and customer service make them a worthwhile solution.

Jan 29, 2024

Business systems analysts connect business needs to technology. They analyze processes, gather requirements, and facilitate communication for efficient project implementation.

Jan 23, 2024

This comprehensive guide offers valuable insights about appointing a health care proxy, their responsibilities, legal rights and ethical considerations, aiming to help individuals make informed medical decisions.

Jan 20, 2024

Short selling is a controversial practice and potentially hazardous for traders. We have outlined some short selling benefits and downsides in this article for you to weigh.

Dec 19, 2023

Knowing the differences between HMOs and PPOs will help you select the health plan that meets your needs at a price that fits your budget. The key distinctions are in the policies governing who is eligible to enroll and who is covered by the plans.

Dec 11, 2023

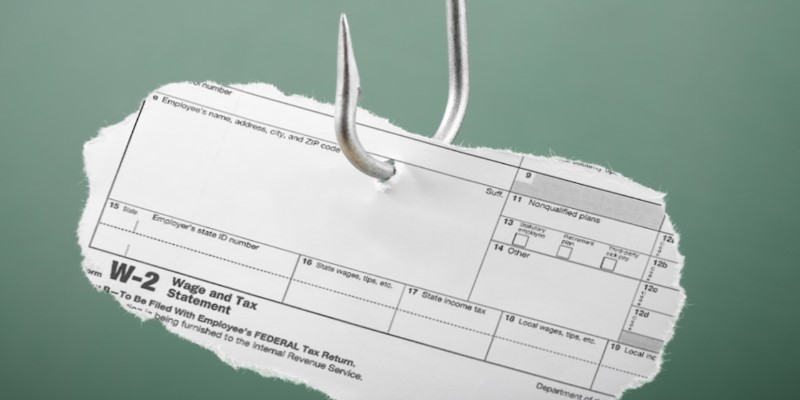

Concerned about W-2 scams during tax season? Learn how to navigate these sophisticated frauds and shield your finances.

Dec 04, 2023

A good American gross domestic product growth is good for the economy, but what happens when the GDP is negative? Learn about how GDP and recession relate to each other in this article.

Dec 02, 2023

The typical cost of attending college continues to climb steadily year after year, and many individuals are beginning to question whether or not the substantial investment is still worthwhile. If you spend all your time, effort, and money, do you think there will be a return on that investment? Attending college will, as the majority of studies continue to demonstrate, almost always result in financial benefits in the long term.

Oct 22, 2023

With over 2.5 million real estate agents and brokers, many people want a profession where they can establish their hours and meet new people while making money—choosing to work as a real estate agent rather than a broker might result in a lower yearly pay of $48,340, compared to the median of $62,010 for brokers.

Oct 15, 2023

Replacement costs should be included in your jewelry insurance policy in the event of damage, loss, theft, or "strange disappearance." You'll need some basic information about the jewelry and an expert appraisal before you can buy an insurance to protect it. Read this detailed account to find out how jewelry insurance works.

Oct 11, 2023

Most of the time, your 401(k) can be used to pay for a house's down payment. Even better, you don't have to pay taxes on 401(k) loans, and the interest rates are low. You were taking money out of your 401(k), while you can hurt your savings for retirement in a big way and for a long time. So using it as a down payment is usually not a good idea.