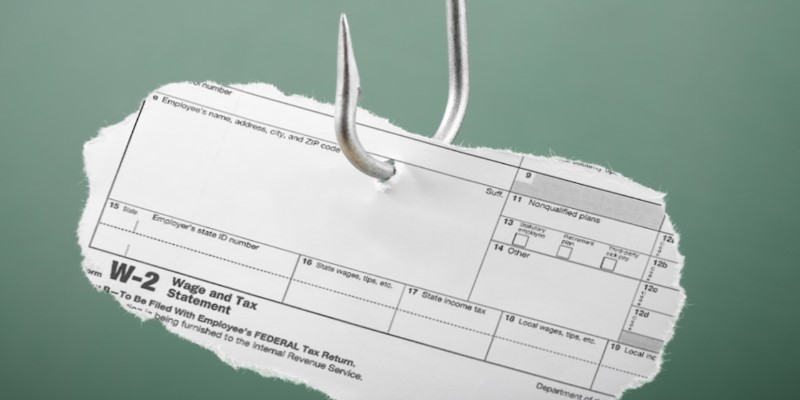

Tax season brings the annual task of filing returns, but it also comes with the risk of W-2 scams. In this guide, we'll delve into the intricacies of what W-2 scams entail, how scammers operate, and, most importantly, how you can shield yourself from becoming a victim.

Understanding W-2 Scams

W-2 scams are sophisticated schemes orchestrated by fraudsters with the aim of acquiring employees' W-2 forms, which are a treasure trove of sensitive information. These forms include crucial data like Social Security numbers and detailed income information. The scammers exploit the vulnerability of tax season, using various deceptive tactics to trick individuals into divulging confidential details.

Fraudsters commonly deploy phishing emails, a form of cyber-attack where deceptive emails are crafted to appear legitimate. In the context of W-2 scams, these emails often impersonate an employee's own company or the HR department. The perpetrators go to great lengths to make the emails seem authentic, mimicking company logos and email formats and even adopting the tone used in typical workplace communication.

How W-2 Scams Unfolded?

The unfolding of W-2 scams typically begins with scammers sending out phishing emails en masse to employees within an organization. The emails, seemingly originating from trusted sources like HR or company management, are carefully designed to create a sense of urgency or importance. They may use subject lines that imply time-sensitive tasks or critical updates regarding tax documentation.

Within the deceptive emails, scammers employ various tactics to convince recipients to disclose their W-2 information willingly. These tactics may include:

- False Urgency: Urgent language and deadlines are often used to pressure recipients into quick responses. Scammers may claim that the information is required urgently for tax processing or other official reasons.

- Mimicking Company Communication: By mirroring the tone and format of legitimate company communication, scammers aim to make their emails indistinguishable from genuine internal messages.

- Personalization: Some phishing attempts involve personalizing the emails with the recipient's name and job title, adding an extra layer of apparent legitimacy.

- Fake Websites:

Scammers may include links in the emails that lead to fake websites resembling official company portals. Employees, thinking they are providing information within a secure company system, unknowingly share their sensitive data.

Unwitting employees, caught off guard by the seeming authenticity of these phishing attempts, may inadvertently provide scammers with their W-2 forms or other sensitive information. Once in possession of such data, fraudsters can exploit it for various malicious purposes, including identity theft and fraudulent tax filings.

Protecting Yourself from W-2 Scams

Ensuring robust protection against W-2 scams involves proactive measures and a collective effort. Here are practical steps to shield yourself and your organization from falling prey to these fraudulent schemes:

Verify Requests

Double-checking the legitimacy of any email requesting sensitive information is a fundamental step in protecting yourself from W-2 scams. Rather than responding directly to the email, take the time to confirm such requests with your HR department or supervisor through established communication channels. Verifying the authenticity of these requests can thwart potential phishing attempts.

Employee Education

A well-informed workforce is a powerful defense against W-2 scams. Employers play a crucial role in educating their staff about the nuances of these scams and emphasizing the importance of verifying requests for sensitive information.

Awareness training should encompass recognizing phishing attempts, understanding the potential risks, and fostering a culture of cybersecurity vigilance within the organization.

Multi-Factor Authentication

Implementing multi-factor authentication (MFA) is a proactive measure that adds extra security to your accounts. Even if scammers manage to acquire login credentials, MFA requires an additional verification step, making it significantly more challenging for them to access sensitive data. This simple yet effective security measure can provide an added safeguard against W-2 scams.

Secure Email Systems

Employers should prioritize the security of their email systems to detect and filter out phishing attempts effectively. This involves the implementation of advanced spam filters, which can identify and block malicious emails before they reach employees' inboxes. Regularly updating security protocols ensures that the email systems remain fortified against evolving cyber threats.

Employee Training Programs

Conducting regular training sessions for employees on cybersecurity best practices is paramount. These programs empower employees to recognize potential threats, understand the tactics employed by scammers, and adopt secure behaviors. Training should not be a one-time event but an ongoing process to keep employees informed about the latest cybersecurity trends and threats.

Recovering from W-2 Scams

In the unfortunate event of a W-2 information compromise, swift and decisive action is crucial to minimize the potential impact on your financial well-being. Here are actionable steps you can take to recover from W-2 scams:

Report to the IRS

Taking immediate action to report the incident to the Internal Revenue Service (IRS) is paramount. File Form 14039, the Identity Theft Affidavit, to officially notify the IRS about the potential fraud.

This form is specifically designed to assist in cases of identity theft related to tax fraud. By promptly alerting the IRS, you initiate the process of investigation and remediation.

Monitor Financial Accounts

Keep a vigilant eye on all your financial accounts for any signs of suspicious activity. Regularly review bank statements, credit card transactions, and other financial records. If you detect any unauthorized or unfamiliar transactions, report them to your bank or financial institution immediately. Timely reporting can help mitigate potential financial losses and prevent further unauthorized access.

Credit Monitoring

Consider enrolling in a credit monitoring service to receive real-time alerts about any unusual activity associated with your identity. Credit monitoring services continuously track your credit reports and notify you of any significant changes or potential fraudulent activities.

This proactive approach allows you to stay informed and take prompt action in the event of unauthorized access or identity theft.

Conclusion

W-2 scams pose a serious threat, requiring individuals and organizations to stay vigilant. By comprehending the intricacies of these scams and taking proactive measures to protect sensitive information, the risk of falling victim to tax-related frauds can be significantly mitigated. Stay informed, educate yourself and your colleagues, and collectively create a safer digital environment during tax season.