In the world of finance, you might come across the term IOU. An IOU is a type of financial document that signifies "I owe you" and recognizes an existing debt between two people or groups. The purpose of this article is to explain what an IOU means, how it works, and give real-life examples of how we use them.

IOU Basics

An IOU is a physical note that represents an individual's or entity's financial commitment. It indicates a debt owed by one party to another and covers many kinds of dealings, from personal loans to business contracts. Even though it may appear casual, an IOU has legal weight and could be utilized as proof in legal actions for demanding payback. Used often in scenarios where formal loan agreements are not needed or not possible, IOUs offer a simple way to record and recognize debts.

Besides creating an official acknowledgment of debt, IOUs can also function as a tool for strengthening trust and responsibility among involved parties. When details about the loan are written down in an IOU, like the amount borrowed and conditions for payback - it helps to create openness and understanding in financial dealings. Additionally, it may assist in avoiding confusion or discord by setting out the responsibilities of each party involved. In personal relationships, being open about finances can help ease the tension that monetary dealings often bring.

- Consideration: While IOUs are legally binding documents, their enforceability may be subject to certain conditions, such as the completeness of the agreement and compliance with relevant laws. It's essential to ensure that all necessary details are included in the IOU to avoid potential disputes or challenges to its validity.

- Caution: Parties should exercise caution when drafting or accepting an IOU to ensure that the terms are fair and reasonable. Careful consideration should be given to factors such as interest rates, repayment schedules, and consequences for default to protect the interests of both the creditor and the debtor.

The Mechanism of IOUs

IOUs work like simple agreements between those who are involved in a lending or borrowing deal. They are not as rigid and demanding as a formal loan contract which usually needs detailed paperwork and legal procedures to be recognized, making them more straightforward for acknowledging debt. The ease of using IOUs makes it usable in many types of financial transactions, from minor personal loans to bigger business activities.

IOUs, besides being useful, also show trust and good relationships among people. These IOUs highlight the significance of personal connections in financial dealings by depending on shared comprehension and spoken arrangements. This casual method can aid in building stronger ties and making transactions go more easily, especially when it comes to matters of a personal or family nature where trust is crucial.

- Consideration: Despite their informal nature, IOUs should still adhere to basic legal principles to ensure enforceability. Parties should strive to include essential details such as the amount borrowed, repayment terms, and signatures of both parties to strengthen the document's validity.

- Caution: While IOUs offer flexibility and simplicity, they may also lack the legal protections afforded by formal loan agreements. Parties should be aware of the potential risks associated with relying solely on an IOU, particularly in cases where disputes or defaults may arise.

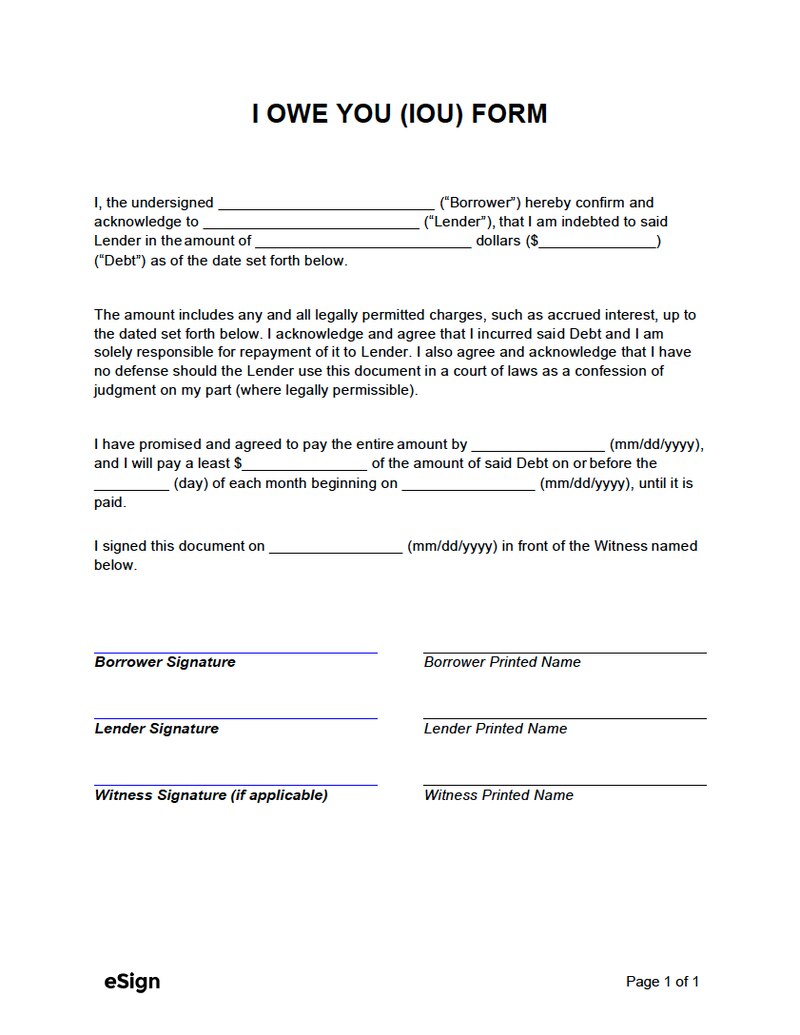

Key Components of an IOU

An IOU, to be effective and clear in its purpose, must have some important parts. The first one is to identify the creditor and debtor. When you put down their names in full along with addresses plus contact info it establishes a strong sense of responsibility for any debt that might exist between these two parties. The identification of the creditor and debtor is a very important part of an IOU. This section provides clarity about who owes money, and who it's owed to, as well as contact information for both involved parties. Also, stating the exact amount owed and the date when it was issued helps to clearly define how much and for what period someone is obligated. The details regarding repayment terms are equally important such as interest rates or payment schedules that both parties agreed upon. By succinctly outlining these essential specifics, an IOU document lessens vagueness and decreases the probability of conflicts or misinterpretations.

Moreover, an IOU can have more elements than just the main ones I explained earlier. It may contain extra clauses or provisions to handle certain situations or possibilities. For instance, parties might add clauses about penalties for late payments, results of defaulting on the agreement, and ways to settle disagreements to make clearer the terms of their understanding. Even if not compulsory, these extra items could improve how thorough and useful this IOU is by giving more safeguarding and direction in case unpredictable situations occur.

- Reminder: It's essential to review and understand all the terms and conditions outlined in an IOU before signing or accepting it. Parties should seek clarification on any ambiguous or unclear provisions to ensure mutual understanding and agreement.

- Note: While standard IOU templates are readily available, parties may benefit from consulting with legal professionals to customize the agreement according to their specific needs and circumstances.

Legal Validity of IOUs

Even though IOUs are not formal documents, they still have some legal weight. If someone refuses to repay an IOU, it can be presented as proof in a court case to support the claim for repayment. The strength of a particular IOU's enforceability may differ based on factors like the location where it was made and whether it is complete or not filled out. Normally, courts tend to support IOUs that meet specific requirements. These include clear identification of the people involved, how much is owed, and details about when and how repayment should occur.

Besides these simple necessities, parties involved in creating an IOU should make sure that it follows all the rules and laws about lending and borrowing in their area. If an IOU does not meet legal requirements, it might be considered unenforceable or open to challenge by a court of law. Because of this reason, it is suggested to write IOUs with caution and thoroughness while getting legal advice if needed to have maximum legal validity and enforceability for them.

- Consideration: Parties should maintain records of all communications and transactions related to the IOU, including correspondence, receipts, and payment records. These documents can serve as valuable evidence in case of disputes or legal proceedings.

- Caution: In cases where significant sums of money are involved, parties may consider formalizing the agreement through a legally binding contract or promissory note to provide additional legal protection and clarity.

Examples of IOUs

IOUs are seen in different areas, showing how they can be used for all sorts of situations. A usual instance is when there's a personal loan between friends or family members. For example, let's say one friend lends some money to another friend so that they can pay for unexpected costs. For this situation, the lender might produce an IOU that lists out how much has been borrowed, when it needs to be paid back, and if there are any interest rates agreed upon. Although not formalized legally, this document signifies trust and good intentions between both sides while maintaining a straightforward record of the debt responsibility.

IOUs are often employed in business deals to record financial arrangements between parties. For example, a supplier might offer the customer credit for goods or services provided, knowing that they will receive payment later on. When this occurs, the supplier can give an IOU that states how much money needs to be paid back and also includes details about when it should be paid off along with any available reductions in price or encouragement bonuses (incentives). When the agreement is put into writing, it helps to reduce risks and ambiguities related to credit transactions for both involved parties.

- Consideration: Parties should exercise caution when using IOUs in business transactions, ensuring that the terms are fair and equitable for all parties involved. Clear communication and documentation are essential to avoid misunderstandings or disputes.

- Note: While IOUs offer a flexible and convenient means of documenting debt obligations, parties should be aware of their limitations, particularly in cases where legal enforcement may be necessary. In complex or high-value transactions, formal contracts or agreements may provide greater legal protection and clarity.

Conclusion

In conclusion, an IOU represents a straightforward yet effective means of documenting a debt obligation between parties. Whether used in personal or business contexts, IOUs serve as tangible evidence of financial transactions and can help mitigate misunderstandings or disputes. By understanding the basics of IOUs and their mechanics, individuals and businesses can navigate financial dealings with clarity and confidence.