A typical home insurance policy covers six main categories, including personal property. Personal property insurance protects your belongings, while homeowners insurance protects the structure. Personal property insurance may cover theft, damage, or destruction of protected belongings. Homeowners' and renters' insurance generally covers personal items. Covered personal items include furniture and devices. Learn the importance of having comprehensive personal property coverage and how to acquire insurance in this helpful article.

What Do We Consider As Personal Property?

In essence, anything you own is thought of as your private property. Consider how you would move your belongings. Insurance may cover lost, stolen, or destroyed personal goods. Your bike, furniture, and gadgets are private. If anything happens to other people's property while under your care, your home insurance may cover it.

Renters sometimes believe their landlord's home insurance covers them and their things. Renters insurance may safeguard your belongings. From clothing to furniture, books to dishes to appliances, almost everything in your house is "personal property," with a few exceptions we'll cover later. Regular homeowners, renters, and condo insurance may cover "named peril" damage. Common dangers like fire and robbery are part of these threats. An example of a typical house insurance policy's coverage is the following (also known as a HO-3):

- Unintentional release of steam or water

- Explosion in the Aircraft

- Things that may fall

- Cryogenic storage

- Lightning Rain

- Riots

- Smoke

- Rapid and unintentional breakdown caused by a short circuit

- Tearing, cracking, scorching, or swelling that occurs suddenly and unintentionally

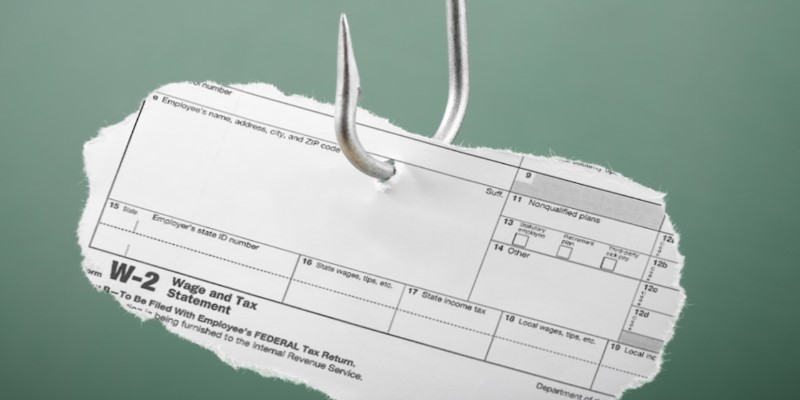

- The heist

- Criminal Damage

- Automobiles (including collisions with vehicles, but not the vehicles themselves)

- Erupting volcano

- Ploughing force of sleet, snow, or ice

- Storm with gusty winds

An "open-peril" or an HO-5 house insurance policy provides more extensive protection for your personal property if you seek extra coverage. Anything not specified excluded from an open-peril policy is covered. Unfortunately, this coverage is not available from every insurance provider.

What Excludes Personal Property Insurance?

Without homeowners, condo, or renter's insurance, earthquakes and floods won't cover your belongings. So, explore earthquake and flood insurance to safeguard against such disasters.

Additionally, not all types of property are covered by personal property insurance. Animals, cars, and aircraft may be uninsured. If you rent out part of your home, your homeowner's insurance won't cover tenants' items. Protecting their belongings requires renters' insurance. Your homeowner's insurance won't cover damage from leased items. Personal property insurance won't protect your belongings from theft while your home is built. You take more risks by storing your stuff in a partly built-structure.

What Amount of Coverage Is Necessary for Your Personal Property?

You want enough personal property coverage to recover from a disaster. What would your goods be worth if a hurricane destroyed your home? What would the total cost be if you had to shop for everything from scratch, even new socks and plates? To compare insurance plans, you should ask yourself these questions. To calculate the appropriate level of coverage for your needs, follow these steps:

- First Step: Go about your house and take pictures or videos of everything you own to make a type of inventory.

- Second Step: Cost estimation comes next. Make sure to include the prices of all the items in your remarks. If you have a lot of one thing, like cooking utensils, it can be quicker to collect them all and come up with a single number.

- Third Step: Determining coverage quantities comes next. Bringing things up a notch here may also be helpful. Add all of your possessions' estimated values to get the grand amount. To ensure enough coverage, round up to $40,000 if your goods are valued at $38,000.

A typical house insurance policy covers 50% of the dwelling limit for personal items. If your house insurance is $300,000, you should carry $150,000 in personal property insurance covers. You may increase coverage as needed. You may value your belongings by inventorying your home. Policyholders may usually select between replacement cost and actual cash value for home, condo, or renter's insurance. The amount you receive back after a loss varies on your policy.

Calculating Personal Property Coverage

Calculating the value of your items and choosing between ACV and RCV coverage will help you choose the right amount of personal property insurance. As your insurance term nears its conclusion, the amount you pay out of pocket for a claim will depend on your chosen coverage.

- Actual cash value (ACV) insurance reimburses you for repairing or replacing your home and belongings minus wear and tear. Depreciated cash value is another name for this kind of coverage.

- With replacement cost value (RCV), you only pay for the coverage you use, so you may fix your house or replace your possessions without worrying about depreciation. Before providing you with the RCV amount, your insurance provider may give you the ACV amount. After you've paid to have anything fixed or replaced, you may send in the receipt to get your money back. Your insurance will cover the gap between that amount and the ACV.

Scheduled Personal Property Coverage

Imagine you have some pricey possessions you would want to acquire additional insurance on. For added peace of mind, consider purchasing scheduled personal property insurance. Based on how your insurance company defines it, this is an endorsement, floater, or rider to your basic home insurance policy.

Premiums tend to rise when scheduled personal property coverage is added but offer greater protection against more risks. A lesser deductible or no deductible at all is an option for planned things as well. To your normal plan, you may add scheduled personal property coverage, which might be useful if you wish to insure any of these valuable items:

- Paintings

- Antiques

- Jewelry

- Vinyl records

- Sports or Music Equipment

- Memorabilia

This is why, once again, it's wise to inventory your possessions. When deciding on the amount of scheduled personal property coverage you need and filing a claim, having the invoices for these expensive things on hand may be useful.